Reciprocal Method of Cost Allocation – Service Department Costing

Definition:

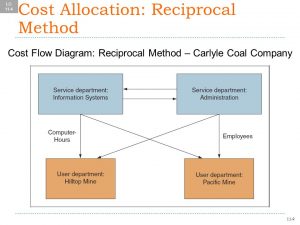

Reciprocal method is a method of allocating service department costs to other departments that gives full recognition to interdepartmental services.

Explanation:

The reciprocal method gives full recognition to interdepartmental services. Under the step method, only partial recognition of interdepartmental services is possible. The step method always allocates costs forward never backward. The reciprocal method, by contrast, allocates service department costs in both directions. The reciprocal allocation requires the use of simultaneous equations. This method is also known as algebraic method and simultaneous equations method.

Under this method the true cost of the service departments are computed first with the help of simultaneous equations and these are then distributed to producing departments on the basis of given percentage or ratio. Remember that true cost of the service department means the cost of the service department which includes original cost of the department plus the share of the other service department. The main advantage of this method is to have an accurate distribution in a single step in the distribution summary.]

Example:

A company has two service and two producing departments. The two service departments serve not only to producing departments but also to each other. The departmental estimates for the next year are as follows.

| Producing departments: A BService departments: X Y |

50,000 40,000 10,000 8,800 |

|||

| The service departments costs are to be distributed as under: Cost of X : 50% to A, 40% to B, and 10% to Y Cost of Y : 40% to A, 40% to B, and 20% to X |

||||

| Required: Transfer the service departments costs to each other and to producing departments. |

||||

| Solution: Now we solve the given illustration first using the simultaneous equation method as follows:Original costs of service departments: X = Rs.10,000 After getting the share from distribution of service departments: X = Rs. 10,000 + 20% Y By putting the value of Y in equation (1) X = Rs. 10,000 + 20%(Rs.8,800 + 10%X) By putting the value of X in equation (2) Y = Rs. 8,800 + 10%(Rs. 12000) |

||||

|

Distribution Summary |

||||

|

Department |

Producing | Service | ||

| Original costs Distribution of service department costs: X YTotal departmental overheads |

A Rs 50,0006,000 4,000 ——- 60,000 ===== |

B Rs 40,0004,800 4,000 —— 48,800 ===== |

X Rs 10,000(12,000) 2,000 ——- Nil ===== |

Y Rs 8,8001,200 (10,000) ——- Nil ===== |

Use of Reciprocal Method:

This method is rarely used in practice for two reasons. First, the computations are relatively complex. Although the complexity issue could be overcome by use of computers, there is no evidence that computers have made the reciprocal method more popular. Second, the step method usually provides results that are a reasonable approximation of the results that the reciprocal method would provide. Thus, companies have little motivation to use the more complex reciprocal method.